Fast & Easy Payday Loans in Fullerton, CA – Get Cash When You Need It!💵🚀

Financial emergencies can strike unexpectedly, leaving you in need of quick cash. Whether it’s a medical bill, car repair, or overdue rent, payday loans offer a fast and convenient way to bridge the financial gap.

In Fullerton, California, payday loans are widely available, providing residents with access to short-term financial relief. However, it’s essential to understand the process, benefits, risks, and alternatives before applying for a payday loan.

✅ What Are Payday Loans?

A payday loan is a small, short-term loan designed to cover immediate expenses until your next paycheck. These loans are typically:

- Loan Amount: $100 – $300 (California state limit)

- Repayment Period: Typically 14 days (or until your next payday)

- Fees: Lenders in California can charge a maximum fee of 15% of the loan amount

- Interest Rate: Payday loans have high APRs, often exceeding 300% on an annual basis

📍 Payday Loan Availability in Fullerton, CA

Residents of Fullerton can access payday loans through:

- Physical Storefronts: Many payday lenders operate locally, offering walk-in services and quick approvals.

- Online Lenders: Numerous payday loan companies provide online applications with same-day or next-day funding, making the process faster and more convenient.

💡 How Do Payday Loans Work?

The process of obtaining a payday loan in Fullerton is straightforward:

- Application: You can apply in person or online by providing basic personal information, proof of income, and a valid ID.

- Approval: Most payday lenders approve applications within minutes, especially if you meet the basic eligibility criteria.

- Funding: Once approved, you receive the loan amount in cash or through direct deposit, often on the same day.

- Repayment: The loan amount, along with fees and interest, is automatically withdrawn from your bank account on the due date.

💰 Benefits of Payday Loans

Payday loans in Fullerton offer several advantages for individuals facing urgent financial needs:

- Fast Approval and Disbursement: Most payday loans are approved instantly, with funds disbursed the same day.

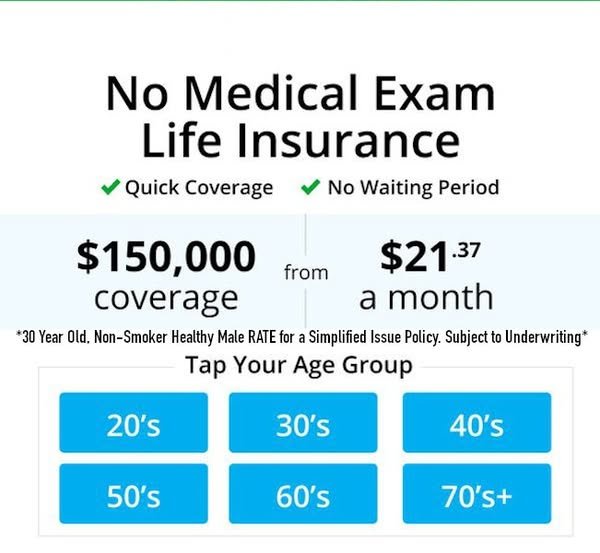

- No Credit Check Required: Many payday lenders do not perform credit checks, making it easier for individuals with poor credit to qualify.

- Simple Application Process: Applying for a payday loan requires minimal documentation, making it a quick and easy solution.

- Flexibility in Usage: You can use the loan for any emergency expense, such as utility bills, car repairs, or medical costs.

⚠️ Potential Risks and Considerations

While payday loans offer fast cash, they also come with potential downsides:

- High Interest Rates: Payday loans in California have extremely high APR rates, making repayment costly if you cannot pay on time.

- Short Repayment Period: With a typical repayment period of 14 days, it can be difficult to manage other expenses.

- Debt Cycle Risk: Many borrowers fall into a cycle of reborrowing, leading to increased debt.

- Impact on Finances: Failing to repay the loan on time can result in penalty fees and affect your financial stability.

🔍 Eligibility Criteria for Payday Loans in Fullerton

To qualify for a payday loan in Fullerton, you generally need:

- Age Requirement: You must be at least 18 years old

- Proof of Income: Recent pay stubs, bank statements, or proof of regular income

- Active Bank Account: Required for direct deposit and automatic repayment

- Identification: A valid government-issued ID (driver’s license, passport, etc.)

💳 Alternatives to Payday Loans

Before opting for a payday loan, consider these alternative financial solutions:

- Credit Union Loans: Many credit unions offer small-dollar loans with lower interest rates and longer repayment periods.

- Installment Loans: These loans allow you to borrow a larger amount with a longer repayment period, making the payments more manageable.

- Personal Loans: Local banks and online lenders offer personal loans with more favorable terms and lower interest rates.

- Emergency Assistance Programs: Residents of Fullerton may qualify for local financial assistance programs or grants offered by non-profit organizations.

📚 Tips for Responsible Payday Loan Borrowing

If you decide to take out a payday loan, follow these tips to avoid falling into a debt trap:

- Borrow Only What You Need: Avoid borrowing more than you can repay by your next payday.

- Choose Licensed Lenders: Ensure the payday lender is licensed in California to avoid scams.

- Understand the Terms: Carefully review the loan terms, including the repayment period, fees, and penalties.

- Create a Repayment Plan: Plan your budget to prioritize loan repayment and avoid costly late fees.

📝 Legal Regulations for Payday Loans in Fullerton

In California, payday loans are regulated under the California Deferred Deposit Transaction Law. Key regulations include:

- Loan Cap: The maximum payday loan amount in California is $300.

- Fee Limit: Lenders can charge a maximum fee of 15% of the loan amount (e.g., $45 fee for a $300 loan).

- Repayment Period: The loan must be repaid in 14 days or by the next payday.

- No Rollovers: California law prohibits payday loan rollovers or extensions.

💡 Conclusion

Payday loans in Fullerton, CA, offer a fast and convenient solution for short-term financial emergencies. However, they come with high fees and short repayment periods, making them a costly option if not managed carefully. Before applying, consider alternative financial solutions and ensure you understand the loan terms thoroughly.

💵 Need quick cash in Fullerton? Explore payday loan options but borrow responsibly!

You May Like: Fast & Easy Payday Loans in Fresno – Get Cash When You Need It!